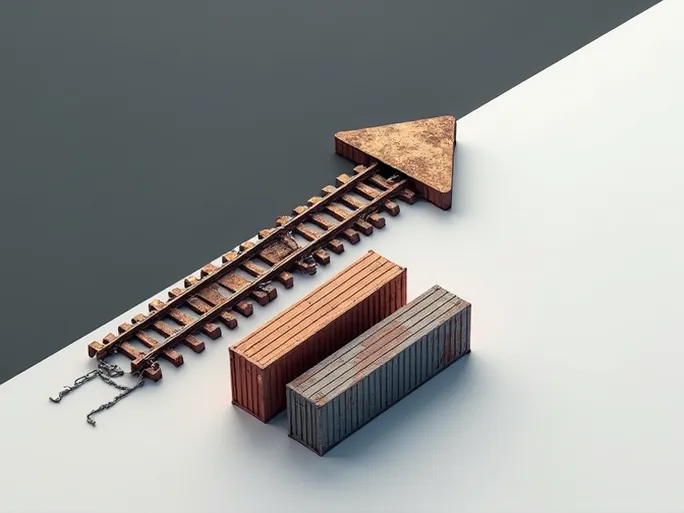

As global supply chains continue to face disruptions, recent data from the Association of American Railroads (AAR) reveals troubling trends in transportation metrics that serve as the backbone of economic activity. The latest weekly report ending August 6 shows year-over-year declines in both rail carloads and intermodal units, signaling potential challenges ahead.

Rail Carloads: Mixed Performance Amid Overall Pressure

While US rail carloads showed a nominal 1.6% year-over-year increase to 230,573 units for the week ending August 6, closer examination reveals weakening momentum. This figure represents a decline from the previous two weeks' volumes of 232,565 (July 23) and 237,079 (July 30) carloads respectively.

The AAR report indicates growth in four of ten major commodity categories. Grain shipments led the gains, adding 1,809 carloads to reach 19,916 units. Non-metallic minerals (primarily construction materials) increased by 633 carloads to 34,409, while agricultural products (excluding grain) and foodstuffs rose by 378 carloads to 15,618. These increases reflect relatively stable demand from agricultural and construction sectors.

However, these gains were partially offset by declines elsewhere. Miscellaneous freight saw the sharpest drop of 2,260 carloads to 7,901 units, followed by chemical shipments (down 1,385 to 32,287) and coal (down 1,076 to 65,812). These reductions point to challenges in manufacturing, energy production, and broader economic conditions.

Intermodal Woes Continue With No Recovery in Sight

The intermodal sector, comprising containers and trailers, recorded 265,953 units - a 3.4% year-over-year decrease. This extends the downward trend from the previous weeks' 266,366 (July 23) and 268,300 (July 30) units. The persistent weakness suggests ongoing supply chain constraints including port congestion, truck driver shortages, and insufficient warehouse capacity.

Year-to-Date Figures Paint Grimmer Picture

Cumulative data through the first 31 weeks of 2022 shows US rail carloads at 7,131,393 (down 0.1% year-over-year) and intermodal units at 8,178,585 (down 5.7%). While rail freight shows modest decline, the steeper intermodal drop creates greater pressure on overall transportation networks.

North American Rail Performance Shows Regional Variations

Expanding to continental metrics, the combined freight of 12 major North American railroads (US, Canada, Mexico) totaled 327,633 carloads (down 0.1%) and 354,967 intermodal units (down 1.2%) for the week. The combined 682,600 units represent a 0.7% overall decline.

Year-to-date North American rail volume stands at 20,917,514 carloads and intermodal units, reflecting a 3% overall decrease. While the continental picture shows similar downward pressure, regional variations in performance exist.

Economic Implications and Future Outlook

Transportation metrics often serve as leading economic indicators, and these declines may signal slowing US economic growth. Reduced shipping demand could reflect weakening business investment, softening consumer demand, and global trade tensions.

The efficiency of rail transportation directly impacts supply chain stability and costs. Declining volumes may lead to higher shipping expenses and delayed deliveries, ultimately affecting corporate profitability and consumer purchasing power.

Industry experts suggest the sector must pursue multiple strategies: increased infrastructure investment to improve efficiency and safety; enhanced collaboration between transportation modes to strengthen intermodal systems; and adoption of digital technologies like AI and big data analytics to optimize operations.

Expert Analysis: Multiple Headwinds With No Quick Fix

Industry analysts attribute the declines to converging macroeconomic factors including global economic slowdown, high inflation, rising energy costs, labor shortages, and geopolitical risks. Supply chain bottlenecks in ports, trucking, and warehousing continue to constrain intermodal performance.

Most experts anticipate no immediate recovery, given persistent global economic uncertainty and entrenched supply chain challenges. The rail industry appears to face prolonged difficulties requiring strategic adaptation to maintain competitiveness.

Policy Considerations for Industry Support

Potential government measures to support the sector could include increased infrastructure funding to enhance capacity and efficiency, along with policies encouraging intermodal adoption to reduce costs and improve supply chain performance.

International cooperation to address global supply chain issues through improved information sharing and policy coordination could enhance system transparency and resilience, supporting broader economic recovery.

The AAR's latest data ultimately reflects broader economic challenges. The rail industry's ability to navigate these difficulties while pursuing modernization will determine its role in future economic activity.