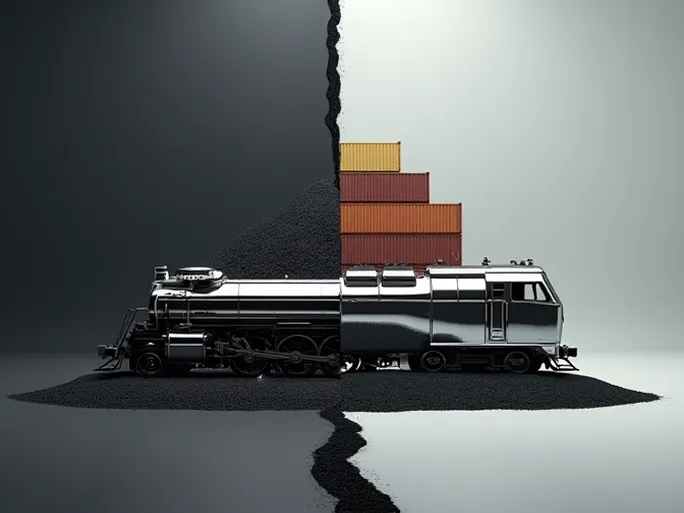

Imagine being a logistics decision-maker facing mountains of goods daily, struggling to determine the most efficient and cost-effective transportation method. Rail transport, as a critical link between production and consumption, serves as a barometer of economic vitality. Recent data from the Association of American Railroads (AAR) reveals intriguing developments in the US rail freight market that warrant closer examination.

Carload Traffic: Coal and Minerals Fuel Double-Digit Growth

The latest AAR report shows US rail carloads reached 236,457 units in the week ending February 12, marking an 11.9% year-over-year increase . This robust performance outpaced previous weeks' results, with seven out of ten commodity categories showing growth.

Coal emerged as the primary driver, contributing 14,634 additional carloads for a total of 69,021 units. Analysts attribute this surge to heightened winter energy demand and global energy market fluctuations. Nonmetallic minerals followed with 5,315 more carloads (28,262 total), while agricultural products (excluding grain) and food shipments grew by 2,022 carloads to 16,911 units.

However, not all sectors shared this prosperity. Petroleum products declined by 345 carloads (9,673 total), automotive shipments dropped 305 units (13,659 total), and miscellaneous freight decreased by 282 carloads (9,649 total). These declines likely reflect ongoing supply chain disruptions, production challenges, and shifting consumer demand patterns.

Container Traffic: Persistent Weakness Amid Global Supply Chain Challenges

In contrast to carloads' strong performance, intermodal traffic (containers and trailers) reached 268,025 units , representing a 0.4% year-over-year decline . While this figure improved over preceding weeks, it pales against carloads' double-digit growth.

Industry experts suggest this weakness stems from persistent global supply chain issues, including port congestion, truck driver shortages, and container circulation inefficiencies. Changing consumer spending habits may also be reshaping freight patterns.

Year-to-Date Performance: Overall Decline Masks Recent Recovery

The broader 2022 picture reveals less optimism. Through the first six weeks, US rail carloads totaled 1,357,008 units ( 0.8% decrease ), while intermodal volumes reached 1,509,334 units ( 11.8% decline ).

These figures suggest that despite recent carload improvements, broader challenges persist—particularly in container traffic, where global supply chain disruptions continue weighing on performance. Future trajectories remain contingent on economic recovery speed, supply chain normalization, and geopolitical developments.

North American Perspective: Mexico Outperforms in Regional Trade

Expanding the lens to North America (US, Canada, Mexico) reveals better overall performance. Weekly carloads reached 329,598 units ( 9.3% growth ), while intermodal traffic stood at 350,974 units ( 0.1% decline ).

Mexico's strong manufacturing and export growth particularly stands out, suggesting the USMCA trade agreement may be fostering regional logistics integration. Year-to-date North American rail volumes total 3,879,720 carloads and containers , representing a 7.8% decline that nonetheless demonstrates resilience amid global economic headwinds.

Key Factors Shaping Rail Freight Dynamics

Several critical elements influence these rail freight fluctuations:

Macroeconomic conditions: Economic expansion naturally drives freight demand for raw materials and finished goods.

Energy markets: Coal and petroleum shipments directly respond to price movements and consumption patterns.

Supply chain efficiency: Port operations, labor availability, and equipment circulation all impact freight volumes.

Consumer behavior: E-commerce growth and demand shifts alter freight composition and routing.

Policy environment: Infrastructure investments, environmental regulations, and trade policies shape rail competitiveness.

Future Outlook: Navigating Uncertainty

The US rail sector faces both challenges and opportunities moving forward. Persistent supply chain disruptions, economic uncertainty, and energy transition pressures present hurdles. Conversely, economic recovery, infrastructure modernization, and technological innovation offer growth potential.

Rail operators must enhance operational efficiency, service quality, and customer collaboration to remain competitive. Simultaneously, policymakers should prioritize rail infrastructure investment and multimodal coordination to strengthen this critical economic artery.