The subtle fluctuations in railroad freight may offer valuable insights into the health of the U.S. economy. Recent data from the Association of American Railroads (AAR) paints a nuanced picture: while traditional carload traffic shows modest declines, intermodal shipping demonstrates steady growth. What economic signals lie beneath these trends?

Carload Traffic: Challenges and Opportunities in Traditional Shipping

For the week ending October 14, U.S. railroads reported 225,405 carloads, marking a 2.0% decrease compared to the same period last year. This figure also represents a decline from the 233,768 carloads recorded in the week ending October 7 and the 235,988 carloads in the week ending September 30. However, a closer examination reveals that not all commodity categories followed this downward trend. Among the ten major categories tracked by AAR, six actually showed year-over-year growth.

Growth Areas:

- Petroleum products increased by 1,774 carloads to 10,583, indicating stable energy demand.

- Motor vehicles and parts rose by 955 carloads to 15,712, suggesting continued recovery in the automotive sector.

- Miscellaneous freight grew by 809 carloads to 8,786, reflecting diversified shipping needs.

Declining Sectors:

- Coal shipments dropped sharply by 4,787 carloads to 62,138, potentially influenced by energy transition policies.

- Grain transport decreased by 2,049 carloads to 22,176, possibly affected by weather conditions and international trade patterns.

- Metallic ores and metals fell by 1,705 carloads to 18,137, potentially signaling manufacturing sector softness.

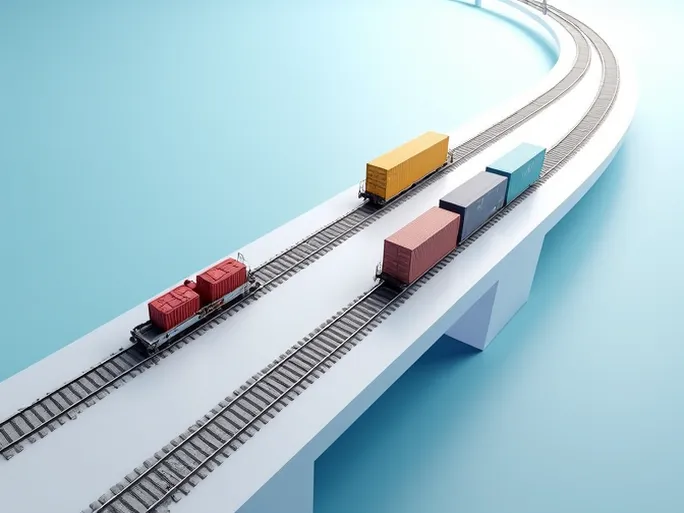

Intermodal Shipping: The Engine of Modern Logistics

In contrast to carload traffic, intermodal units (containers and trailers) showed robust performance at 267,376, representing a 2.8% year-over-year increase. This figure exceeds the 265,449 units recorded in the week ending October 7 and the 264,166 units in the week ending September 30, demonstrating intermodal's continued expansion as a critical component of contemporary supply chains.

The growth of intermodal shipping stems from its efficiency, flexibility, and environmental advantages. By integrating rail, road, and maritime transport, intermodal solutions offer door-to-door service while reducing costs, transit times, and carbon emissions. As global trade continues to evolve, intermodal's significance becomes increasingly apparent.

Year-to-Date Figures: Emerging Annual Trends

Through the first 41 weeks of 2023, U.S. railroads have moved 9,234,003 carloads, a marginal 0.3% increase compared to the same period last year. While modest, this growth suggests overall freight demand remains stable. Intermodal units totaled 9,862,159 during this period, representing a 7.7% decline that likely reflects earlier global supply chain disruptions and shifting consumer demand patterns. However, with economic recovery gaining momentum in the latter half of the year, intermodal performance may strengthen further.

Underlying Factors and Future Outlook

Multiple economic forces shape railroad freight patterns, including macroeconomic conditions, energy prices, industrial transformations, trade policies, and technological advancements. Understanding these dynamics provides crucial context for interpreting current market conditions and anticipating future developments.

- Economic growth remains the primary driver of freight demand, with recovery stimulating manufacturing, retail, and construction sectors.

- Energy market fluctuations directly impact shipments of petroleum and coal while potentially making rail transport more attractive during periods of high fuel costs.

- Industrial evolution creates structural shifts in freight demand as traditional industries decline and emerging sectors expand.

- International trade policies significantly influence import/export volumes, with protectionist measures potentially reducing shipments while trade agreements may stimulate growth.

- Technological innovation enhances rail efficiency through automation, digitalization, and smart systems, improving competitiveness.

Looking ahead, U.S. railroads face both opportunities and challenges. Economic recovery and infrastructure investments may create growth potential, while energy transitions and environmental regulations could pressure traditional operations. Rail operators must navigate these dynamics through innovation and strategic adaptation to ensure sustainable development.

Railroad freight data serves as more than statistical aggregates—it provides vital insights into economic vitality. By analyzing these indicators, we gain clearer understanding of economic conditions and emerging trends. As a fundamental component of economic infrastructure, rail transportation will continue playing its indispensable role in supporting American prosperity.