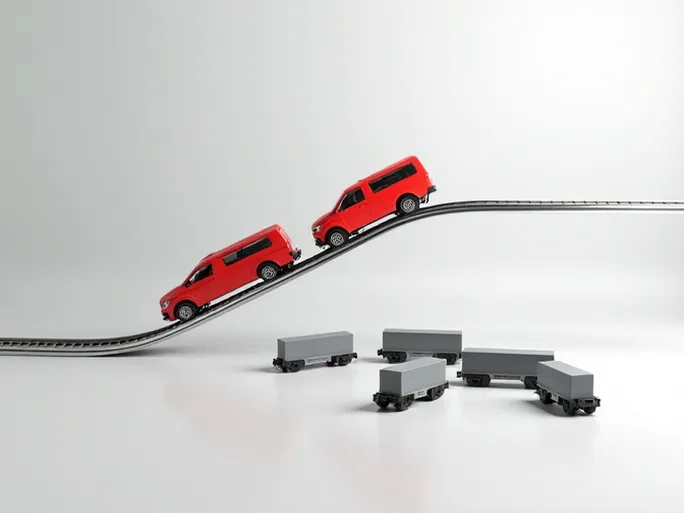

When the global economy slows, rail freight volumes are often among the first indicators to reflect the chill. The latest data from the Association of American Railroads (AAR) reveals concerning declines in both rail carloads and intermodal traffic during the week ending December 12, sounding fresh alarms about mounting economic pressures.

The figures show U.S. rail carloads fell sharply to 270,953 units, a 13.2% year-over-year decrease . While this represents an improvement from the Thanksgiving-impacted week of November 28 (230,919 carloads), it marks a continued downward trend from the 271,774 carloads recorded the prior week. Among the ten major commodity categories tracked by AAR, only two showed annual growth: miscellaneous freight (up 39.5% to 10,764 carloads) and motor vehicles/parts (up 1.8% to 19,502 carloads). The modest growth in automotive shipments may signal recovery in that sector, but the broader decline remains troubling.

Intermodal traffic similarly contracted, dropping 2.3% year-over-year to 274,022 containers and trailers. Though higher than the previous two weeks' totals, the annual decline underscores growing challenges in multimodal transportation markets.

Sector Performance: A Mixed Picture

Deeper analysis reveals significant variations across commodity groups. The surge in miscellaneous freight likely reflects temporary factors rather than sustained demand, while automotive gains align with stable domestic vehicle sales. However, declines in coal, chemicals, and agricultural products—traditionally strong rail commodities—point to broader industrial weakness.

The Economic Barometer

Rail freight volumes serve as a reliable economic barometer, with declines typically preceding slowdowns in manufacturing and consumer activity. These latest figures reinforce recent signals of weakening U.S. economic momentum. Given global uncertainties and domestic consumption challenges, rail operators may face prolonged headwinds.

Challenges and Opportunities Ahead

The rail industry confronts multiple pressures: slowing global growth, depressed energy markets, and trucking competition. Yet infrastructure investments and intermodal innovations present opportunities. Rail operators must adapt through strategic adjustments and technological upgrades to maintain competitiveness.

Policy Considerations

To strengthen rail freight's role in the transportation ecosystem, policymakers could prioritize infrastructure modernization, operational efficiency improvements, and enhanced international rail connections. Strategic support for intermodal development may help offset current declines while positioning the sector for future growth.