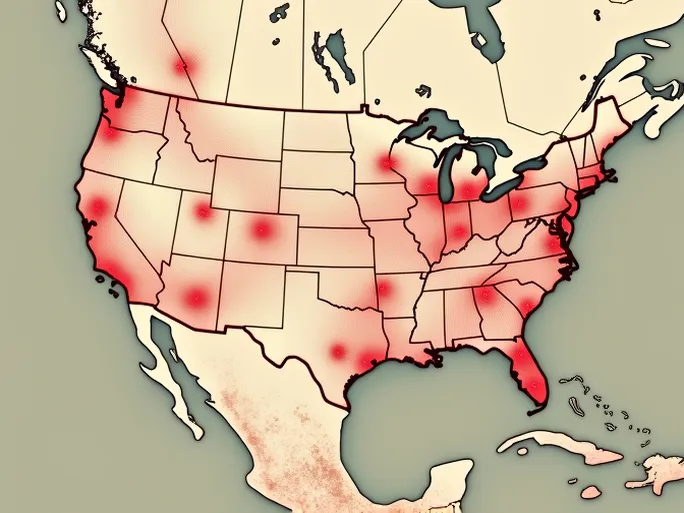

As global supply chain focus appears to be shifting from Asia to North America, are logistics managers prepared for the accompanying risks? A new report from Resilinc serves as a wake-up call for those evaluating "nearshoring" strategies. The findings reveal a surprising trend: North America is displacing Asia as the primary region for supply chain disruptions, signaling the need for significant adjustments in risk management approaches.

Key Findings: North America Emerges as Risk Hotspot

Resilinc, a California-based cloud service provider specializing in supply chain resilience and risk management intelligence, found through its EventWatch 24X7 monitoring service that most supply chain disruptions in 2016 occurred in North America—surpassing Asia's event count from 2015. This shift warrants close attention amid changing global manufacturing patterns.

"Given current discussions about shifting offshore manufacturing closer to home markets, this represents a significant indicator," noted Resilinc CEO and founder Bindiya Vakil. "Even cross-border trade may face heightened scrutiny as political agreements with Mexico evolve."

Sector Analysis: Life Sciences Surpasses Automotive Industry

The report provides detailed risk assessments across industries. While Mexico remains relatively stable for automotive and life sciences operations, the life sciences sector has overtaken automotive as the most frequently impacted industry. This change stems primarily from increased merger activity and regulatory actions by the FDA and European Medicines Agency.

Mergers and acquisitions accounted for 20% of all EventWatch notifications in 2016. "These acquisitions can prove highly disruptive as new owners typically focus on cost-cutting and restructuring," Vakil explained. "For many suppliers, this often translates to reduced demand."

Root Causes of North America's Rising Supply Chain Risks

Several critical factors contribute to North America's growing supply chain vulnerabilities:

- Aging Infrastructure: The region's transportation networks—including roads, bridges, ports and railways—require significant upgrades and remain vulnerable to natural disasters and accidents.

- Natural Disasters: Frequent hurricanes, floods, earthquakes, tornadoes and winter storms can paralyze production and logistics operations.

- Labor Challenges: Higher labor costs, workforce shortages and potential labor disputes create operational uncertainties.

- Regulatory Complexity: Evolving federal, state and local compliance requirements increase operational costs and potential disruptions.

- Geopolitical Factors: Trade policy shifts and border security issues impact cross-border supply chains.

- Cyber Threats: Increasing digitalization exposes supply chains to data breaches and system failures.

Strategies for Mitigating North American Supply Chain Risks

Logistics professionals should consider these approaches to enhance supply chain resilience:

- Conduct comprehensive risk assessments and implement continuous monitoring systems

- Diversify supplier networks and manufacturing locations

- Maintain strategic inventory buffers while optimizing turnover

- Strengthen collaborative relationships with key suppliers

- Leverage advanced technologies like AI and blockchain for enhanced visibility

- Develop and regularly test detailed contingency plans

- Implement robust cybersecurity measures across supply chain systems

- Monitor policy developments that may affect operations

Evaluating Nearshoring: Balancing Risks and Rewards

Nearshoring—relocating production to nearby countries like Mexico or Canada—offers potential benefits including shorter lead times, lower transportation costs and improved responsiveness. However, this strategy introduces its own challenges related to political stability, labor conditions and regulatory differences.

When assessing nearshoring options, companies should evaluate:

- Political and economic stability in target countries

- Labor market conditions including cost and skill availability

- Regulatory environments and compliance requirements

- Infrastructure quality and capacity

- Cultural compatibility and communication considerations

Conclusion: Building Adaptive Supply Chains

The Resilinc report underscores the dynamic nature of global supply chain risks. To maintain competitiveness, organizations must proactively strengthen supply chain resilience through strategic planning, technological investment and collaborative partnerships. As manufacturing footprints evolve, careful evaluation of nearshoring alternatives will become increasingly critical for sustainable operations.