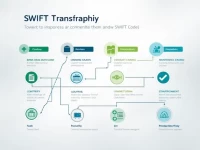

Bank of Africa Burkina Faso Simplifies SWIFT Code Transfers

The SWIFT code for Banque Ouest Africaine de Développement (BOA) Burkina Faso is AFRIBFBFXXX. To avoid any issues with international money transfers, it is highly recommended to verify the specific code with the recipient or the bank directly. Using the correct SWIFT code ensures the funds are routed to the intended bank branch in Burkina Faso, preventing delays or misdirection of funds. Always double-check the information before initiating a transfer.