Central Bank of Egypt Enhances Remittance Safety With SWIFT Codes

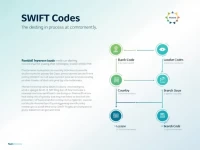

Learn about the SWIFT code of the Central Bank of Egypt (CBEGEGCAASA) to ensure safe and accurate remittances. This article outlines the structure of SWIFT codes and key verification points, assisting users in successfully completing international transfers.