USD to LKR Exchange Rate Volatility Reflects Sri Lankas Economic Strain

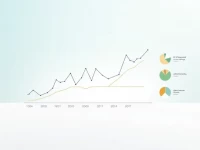

This article analyzes the exchange rate dynamics of 1 USD to the Sri Lankan Rupee, currently at 300.71 LKR, with a fluctuation of 0.29% over the past 30 days. By comparing historical data, it explores the relationship between exchange rate fluctuations and international economic decisions, highlighting the importance of monitoring exchange rate changes.