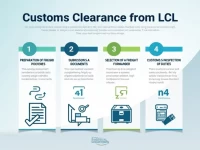

Comprehensive Analysis of Import and Export Customs Declaration Process

This article explores the importance and key steps of the customs clearance process in import and export, emphasizing the critical role of customs declarations, shipping, and commercial documents in the clearance process. It provides insights on customs review, specific document requirements, and important considerations regarding import and export licenses, helping readers enhance their understanding of the customs procedures to promote industry efficiency and compliance.