National Bank of Pakistan Simplifies SWIFT Transfers

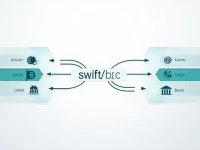

This article provides an in-depth analysis of the National Bank of Pakistan's SWIFT/BIC code, NBPAPKKA02H, explaining its structure, application scenarios, and significance. It guides readers on the accurate use of this code for cross-border remittances, helping to avoid potential risks and ensure the safe and efficient arrival of funds to the recipient. The article also explores future trends in cross-border payments, highlighting the evolving landscape of international financial transactions. The focus is on practical application and understanding the importance of accurate SWIFT code usage.