US Manufacturing Rebounds As Services Sector Expands ISM

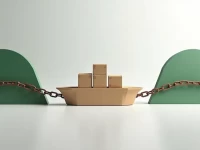

The latest ISM report indicates moderate growth in US manufacturing and robust expansion in the service sector for 2024. Manufacturing saw accelerated capital expenditure but slightly weaker revenue growth. Conversely, the service sector demonstrated strong growth in both revenue and investment. The report forecasts continued growth in both manufacturing and service industries for 2025, albeit with persistent internal structural differences. While manufacturing is investing, revenue lags. The service sector shows strength across the board. This divergence suggests varied supply chain pressures and investment strategies for the coming year.