China Streamlines Bonded Zone Exports with Consolidated Shipping Rules

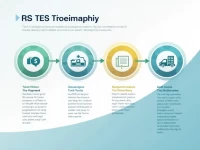

This article provides a detailed analysis of the self-consolidation export process for goods from bonded zones. It covers key steps such as customer customs declaration, freight forwarder preparation, customs seal handling, and customs broker operations. The article also addresses common issues related to container loading, customs declaration, and port area data. The aim is to assist foreign trade enterprises in efficiently and compliantly completing the export of goods from bonded zones, ensuring adherence to regulations and streamlining the overall process.