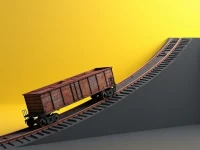

US Rail Freight Gains in Carloads Loses in Intermodal

According to the Association of American Railroads, U.S. rail carload traffic increased by 2.8% year-over-year for the week ending March 5th, driven primarily by chemicals, minerals, and coal. However, intermodal traffic decreased by 5.8% year-over-year, potentially indicating weak consumer demand. Year-to-date figures show a similar trend. Overall, North American rail freight is facing pressure. Rail freight data reflects the economic pulse, and investors can pay attention to rail operators, equipment suppliers, logistics service providers, and related industries.