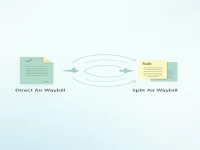

Direct Vs Indirect Customs Brokerage Key Differences Explained

This paper explores the key differences between direct and indirect customs agency in international trade. It analyzes the applicable scenarios and advantages and disadvantages of each method, assisting businesses in making more informed decisions when choosing their agency model to ensure the efficiency and smoothness of import and export processes.