Comprehensive Analysis of Export Express and Its Customs Declaration Process

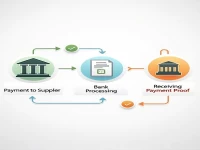

Export express refers to the international shipping of documents and goods, categorized into documents, personal items, and merchandise. Different types of customs declaration forms, such as KJ1, KJ2, and KJ3, must be submitted based on the purpose of export. The customs process is simple, cost-effective, and allows for fast clearance. This process caters to the needs of e-commerce and overseas shopping, making rapid and efficient customs clearance a significant advantage for export express.