US Supply Chain Council Boosts Resilience Efforts

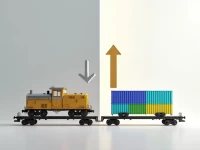

The Supply Chain Council (SCC), a bipartisan organization, aims to strengthen U.S. supply chains by uniting businesses and labor. Its mission is to protect jobs, invest in infrastructure, and address global instability. Emphasizing collaboration and advocacy, the Council promotes policies at all levels to enhance supply chain resilience and sustainability, tackling current global supply chain challenges. The SCC seeks to foster a robust and secure supply chain ecosystem for the United States.