US Service Sector Shows Growth Despite Economic Challenges

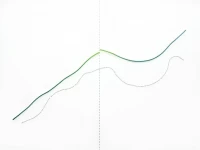

The US Services PMI has grown for five consecutive months, but the growth rate is slowing, reflecting challenges to economic recovery. Industry divergence is evident, and businesses are concerned about future uncertainty. Experts believe the economy is returning to normal, but inflation, the labor market, and geopolitical risks remain. The future of the service sector is uncertain, and businesses need to be cautious. The slowdown suggests a more moderate pace of economic expansion and highlights the ongoing complexities in the current economic landscape.