US Rail Freight Auto Petroleum Up As Coal Declines

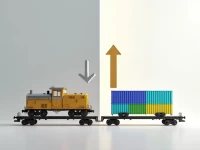

According to the Association of American Railroads, U.S. rail freight traffic decreased by 7.9% year-over-year for the week ending May 9, while intermodal traffic increased by 3.8%, showing a diverging trend. Shipments of motor vehicles & parts and petroleum products increased, while coal shipments decreased significantly. Year-to-date, rail freight traffic is down 1.8%, and intermodal traffic is up 1.7%. Rail freight companies need to actively transform and expand their intermodal transportation business.