North American Intermodal Traffic Declines Amid Industry Shifts

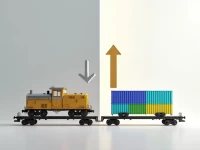

Data from the Intermodal Association of North America (IANA) shows a continued decline in North American intermodal volumes, though the rate of decrease is slowing. This downturn is attributed to a combination of macroeconomic conditions, internal industry factors, and geopolitical influences. IANA suggests that challenges and opportunities coexist, identifying cross-border trade as a potential growth area. Businesses need to transform and innovate, improve service quality and efficiency, expand service offerings, embrace technological innovation, and strengthen cooperation and collaboration to succeed in this evolving landscape.