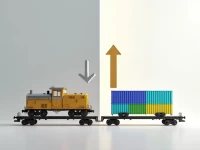

US Tariff Extension Rattles Global Supply Chains

The extension of the US reciprocal tariff suspension to August 1st has drawn global attention to supply chains. This article delves into the tariff logic of the Trump administration, analyzing the underlying dynamics and risks of the extension. It explores how businesses can cope with the uncertainties brought about by tariff policies, emphasizing the importance of cost control, risk management, and sustainable development.