China Tightens Customs Rules to Curb Personal Shopping Proxies

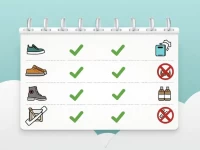

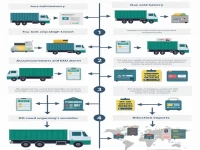

Starting June 1, China Customs has implemented new regulations for incoming travelers' luggage, prohibiting the release of five categories of imported goods to curb personal purchasing. Travelers must ensure their personal items from abroad fall within a 'reasonable quantity for personal use'; any excess will be temporarily held and subject to customs procedures. The tax exemption policy outlines specific restrictions for cigarettes, discs, and electronic products, which require special attention to compliance. Failure to adhere to these rules may result in customs intervention.