HS Codes for Agricultural Products Boost Global Trade

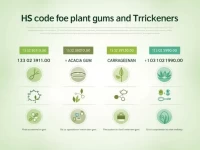

This article provides a detailed analysis of agricultural products related to HS Code 12, including endangered seeds, hops, and American ginseng. It explores their export conditions and market demand, offering insights for agricultural enterprises looking to engage in international trade.