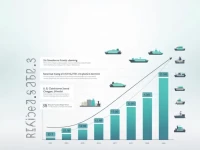

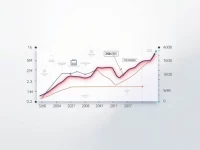

US Container Imports Drop Sharply Signaling Trade Slowdown

S&P Global data reveals a 3.4% year-over-year decline in US import container shipping volume for October, signaling potentially larger drops in the coming months. Key factors include inventory overhang, structural shifts in consumer demand, and trade policy uncertainty. Businesses should refine demand forecasting and optimize inventory management. Governments need to stabilize trade relations and improve the business environment to collectively navigate this trade downturn.