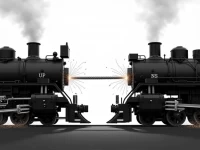

Prologisamb Merger Transforms Global Logistics Real Estate

The merger of GLP and Prologis signifies a major shift in the global logistics real estate landscape, increasing market concentration and service capabilities. This consolidation not only expands market share but also enhances operational efficiency and customer service. Facing future supply chain challenges, businesses need to build more resilient systems through diversification, digital transformation, and infrastructure investment. The development of logistics real estate will profoundly impact global trade and our daily lives. This merger positions GLP as a dominant force in the sector, ready to address evolving supply chain demands.