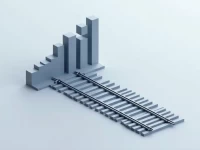

US Rail Freight Declines Midyear Amid Industry Shifts

Data from the Association of American Railroads indicates a year-over-year decline in U.S. rail freight and intermodal volume for the week ending June 25th. While sectors like chemicals and agricultural products experienced growth, coal and metals saw decreases. Year-to-date freight volume is slightly down, with a more significant drop in intermodal traffic. The rail industry needs to proactively transform by improving efficiency, expanding services, and embracing digitalization to address challenges and capitalize on future opportunities.