HS Code 7115901090 Gains Industrial Significance

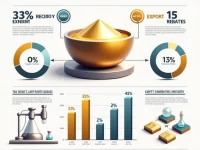

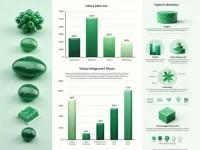

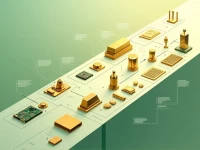

This article discusses the application and tax rate information of HS Code 7115901090, analyzing its significance in industrial and laboratory settings. It provides a detailed overview of declaration elements, regulatory conditions, and international agreement tax rates, offering practical references for related industries.