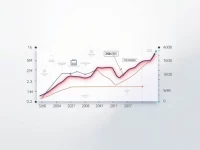

USD to AUD Exchange Rate Trends Analyzed Amid Market Volatility

The current exchange rate of the US Dollar to the Australian Dollar is 1.53088, reflecting a 0.23% decrease compared to the same period last year. This fluctuation indicates that the US Dollar is under pressure in international trade, influenced by various economic and policy factors affecting the relationship between the Dollar and the AUD. Investors should pay attention to the market dynamics and future trends behind exchange rate changes.