Understanding Customs Clearance Fees Avoid High Costs and Optimize Your International Trade

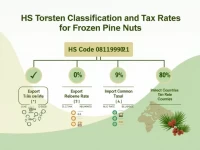

Customs clearance fees are a crucial aspect of international trade, encompassing various costs such as import duties, taxes, and customs agent fees. Understanding these expenses helps optimize import and export operations while avoiding unnecessary costs. Additionally, duty exemption policies in different countries can facilitate the import of low-value goods.