Container Shipping Slump Alters Global Ecommerce Logistics

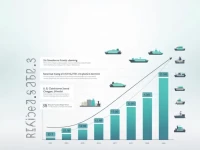

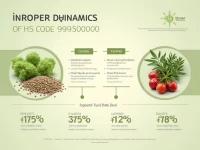

Global container freight rates continue to fall, impacting shipping industry profits and reshaping cross-border e-commerce logistics. Land transportation is gaining prominence, with Amazon Air expanding its regional presence, leading to freight rate differentiation. The China-Europe Railway Express supports the Belt and Road Initiative. Amazon is optimizing inventory placement in preparation for peak season. Air freight is accelerating China-Europe trade, and the shift from road to rail promotes low-carbon logistics. Chinese companies are accelerating the deployment of European warehousing to address tariff challenges. These trends highlight the evolving landscape of global trade and logistics.