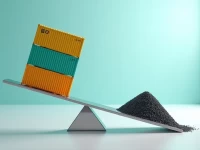

US Rail Freight Intermodal Gains Offset Coal Decline

The U.S. rail freight market showed a mixed picture for the week ending February 10th. Intermodal traffic performed strongly with an 11.1% year-over-year increase, while traditional rail carloads declined by 2.5%. Coal shipments continued to be weak, decreasing by 7,264 carloads year-over-year. Year-to-date figures reveal a 6.5% rise in intermodal volume and a 6.4% drop in rail carloads, reflecting the evolving U.S. economic structure and changes in supply chain patterns.