Union Pacifics 85B Rail Merger Delayed by Regulatory Scrutiny

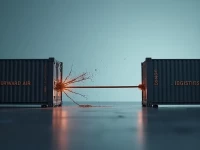

The $850 billion merger between Union Pacific and Norfolk Southern has been delayed due to technical issues, sparking strong opposition from competitor BNSF and raising concerns in the port industry. The merger aims to create the first transcontinental railroad in the United States. However, it faces the dual challenges of regulatory scrutiny and a changing competitive landscape. This proposed merger will significantly impact the rail industry and requires careful examination of its potential effects on competition and infrastructure.