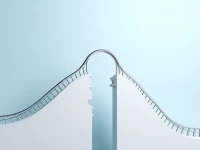

North American Class 8 Truck Orders Drop Sharply Amid Freight Shift

North American Class 8 truck orders experienced a significant drop in November, raising concerns about the freight market outlook for 2024. Expert opinions are divided, ranging from views of a short-term correction to warnings of longer-term underlying issues. This article delves into the potential reasons behind the order decline and explores future market trends, offering coping strategies for transportation companies. The downturn fuels worries about a potential economic recession impacting the trucking industry and overall freight demand in the coming year.