Singapore SWIFTBIC Codes Guide for International Transfers

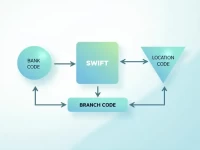

This article details the importance, lookup methods, frequently asked questions, and precautions regarding Singapore SWIFT/BIC codes. It aims to help readers accurately execute international remittances, avoiding delays, failures, or financial losses caused by incorrect codes. The article provides examples of major bank codes and practical advice to facilitate cross-border money transfers. Understanding SWIFT codes is crucial for ensuring smooth and successful international transactions when dealing with Singaporean banks.