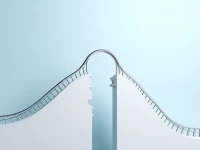

US Tariff Shifts Challenge Crossborder Ecommerce Strategies

The Trump administration's tariff policy experienced a rapid reversal within 24 hours, highlighting the uncertainty of the US tariff environment. Cross-border e-commerce businesses should mitigate risks through market and platform diversification, and enhancing supply chain resilience. Multi-platform management tools, such as E-Cang ERP, can help companies operate efficiently and cope with trade challenges.