Streamline Global Trade Launches Forex and Export Tax Refund Platform

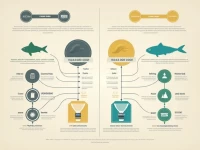

This paper introduces the concepts of forward and reverse exchange in foreign exchange receipt and payment, emphasizing the importance of providing one-stop foreign exchange receipt and payment and export tax rebate services for foreign trade enterprises. This service aims to help companies simplify processes, save time and effort, and focus on core business development through a professional team, efficient processes, and compliance guarantees. It streamlines operations and allows businesses to concentrate on growth, ensuring a seamless and compliant experience in international trade.