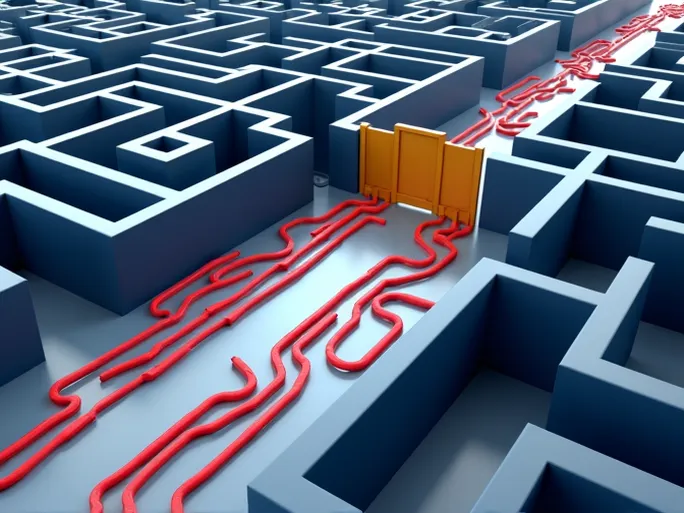

When businesses eagerly prepare to establish their presence on Walmart's marketplace, many find the final activation stage unexpectedly challenging due to stringent compliance reviews. Numerous merchants have recently voiced concerns about what they describe as unreasonable aspects of Walmart's compliance verification process, which they claim significantly delays store openings and creates unnecessary obstacles.

"A single phone call with a misunderstanding can lead to immediate store suspension," shared one anonymous seller, who recounted several perplexing cases that highlight systemic issues in Walmart's compliance procedures.

Case 1: Rigid Verification Methods

One company listed both office and personal phone numbers of its legal representative on Bank of China documentation. When Walmart's compliance team called the office number, the receptionist—unaware of the Walmart store application—responded "I don't know" to verification questions. The compliance department immediately suspended the application for "information discrepancy," without further verification attempts.

Case 2: Instant Suspension for Missed Calls

Another merchant reported that after just two unanswered calls from the compliance team, their application was automatically suspended for being "unreachable." This automated approach left sellers with no opportunity for clarification or follow-up.

Case 3: Poor Signal Leads to Rejection

In a particularly surprising incident, a seller answering from an ESD-protected workshop experienced call quality issues due to weak signal. Rather than requesting a callback or alternative verification method, the compliance team cited "poor connection quality" as grounds for suspension.

Case 4: Inconsistent Contact Methods

Several sellers noted that compliance officers sometimes bypass the officially registered phone numbers entirely, instead sourcing company contacts through third-party business databases. When reaching accounting personnel unfamiliar with the Walmart application, these calls similarly result in automatic rejections.

These examples represent widespread frustrations among Walmart marketplace applicants. Many describe the compliance department as inflexible and uncommunicative, with excessively rigid standards that lead to numerous unjustified rejections—dampening seller enthusiasm for the platform.

Industry analysts note that while compliance verification serves as a crucial safeguard for marketplace integrity, Walmart's current approach appears counterproductive. The "zero-tolerance" system intended to protect the platform has instead become a significant barrier to legitimate sellers seeking to join.

"The real challenge isn't operating on Walmart—it's getting approved in the first place," commented one successful seller preparing to share operational best practices at Walmart's invitation. Their experience underscores how compliance hurdles precede all other marketplace challenges.

Experts recommend several improvements to Walmart's verification process: implementing human review for borderline cases, providing clearer documentation requirements, and establishing transparent appeal channels. Such measures could maintain compliance standards while reducing unnecessary obstacles for qualified sellers.

How Walmart addresses these concerns will significantly impact the health and growth of its marketplace ecosystem. The effectiveness of any forthcoming changes remains to be seen.