[City, Date] – As e-commerce flourishes and labor markets tighten, the global retail sector is undergoing an unprecedented transformation. At the heart of this shift lies the rapid advancement and widespread adoption of robotics technology. From warehouses to storefronts, picking to delivery, robots are permeating every facet of retail at an extraordinary pace, fundamentally altering operational models and competitive dynamics.

Gartner Forecast: Retail Giants Establish Dedicated Robotics Units

Leading research firm Gartner recently released a landmark report predicting that by 2025, at least two of the world's top ten retailers will create specialized "Robotics Resource Departments." This projection stems from deep analysis of industry trends. These departments will manage growing robotic fleets, optimize deployment strategies, and ensure seamless human-robot collaboration.

E-commerce Boom Squeezes Profits: Robotics Become Retail's Lifeline

The pandemic accelerated e-commerce adoption while presenting retailers with unprecedented challenges. Online order processing costs significantly exceed in-store sales, compressing profit margins. To survive intensifying competition, retailers must discover new growth avenues and efficiency solutions.

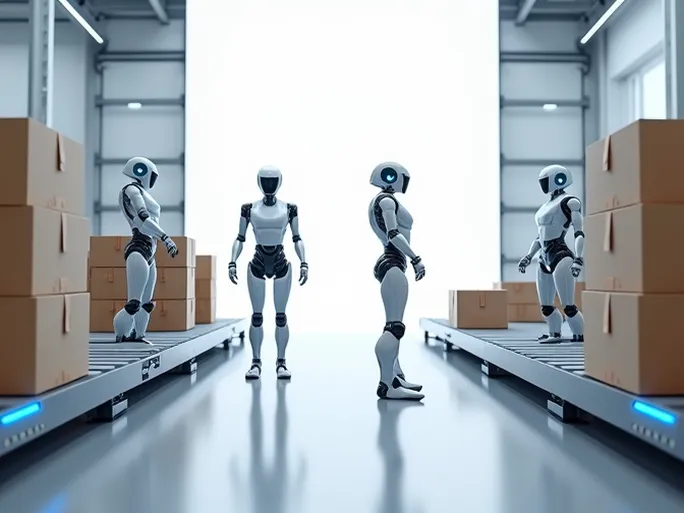

Robots excel at repetitive tasks like picking, packing, sorting, and transporting goods, freeing human staff for higher-value customer service, sales, and marketing activities. Their 24/7 operational capacity further enhances productivity.

The food and consumer goods sector leads robotics adoption, with first-quarter orders surging 32% year-over-year—far exceeding the 20% industry average. This reflects growing investments to meet soaring online demand.

Automation Arms Race: Retail Titans Compete for Technological Edge

Retail giants are escalating robotics investments to position fulfillment processes closer to delivery points, sparking an industry-wide technological arms race.

Walmart announced plans to install automated micro-fulfillment centers across dozens of stores, partnering with Alert Innovation, Dematic, and Fabric. These compact facilities leverage advanced robotics for rapid online order processing.

Kroger employs Ocado's robotic systems at Florida fulfillment centers to pick orders for delivery vehicles. The grocer considers robotics investments more valuable than new store construction for boosting efficiency and customer satisfaction.

Lightning Deployment: Retailers Accelerate Robotics Rollouts

Facing surging demand, retailers are compressing pilot timelines and rapidly scaling implementations. "The speed and scale at which major clients want to move is astonishing," Seidl acknowledged.

Marian predicts that regardless of departmental naming conventions, multiple retailers will establish specialized robotics management structures. Tompkins Robotics CEO Mike Futch observes that major retailers and parcel carriers already form innovation engineering teams, while supermarket chains assemble micro-fulfillment units to evaluate and integrate automation solutions.

The Road Ahead: Human-Robot Collaboration Defines Retail's Future

As robotics technology advances and costs decline, machines will assume increasingly critical retail roles. The future will see humans and robots working synergistically—with automation handling repetitive tasks while employees focus on creative, customer-facing responsibilities.

Retailers must proactively develop specialized teams to manage these robotic workforces, collaborate with technology providers, and craft strategic implementation plans. The "Robot Revolution" has commenced, and those who harness its potential will dominate tomorrow's retail landscape, delivering unprecedented efficiency and shopping experiences.