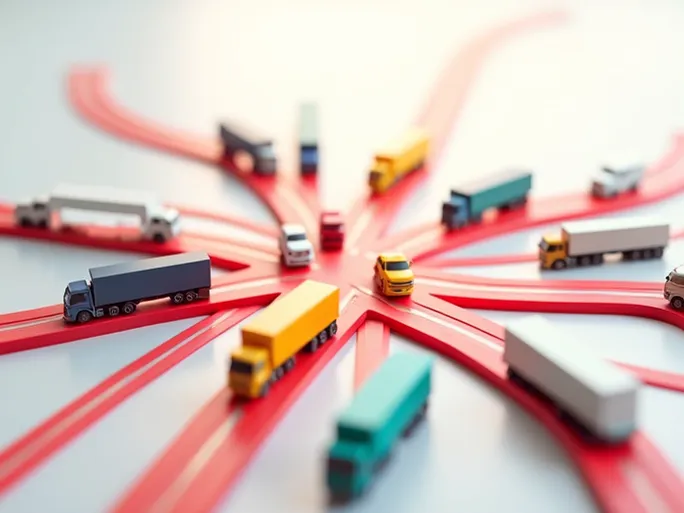

Truck transportation serves as the primary method of land-based freight movement, playing a pivotal role in the global economy. Connecting producers, distributors, retailers, and end consumers, trucking forms the vital circulatory system of commerce. From raw material transport to finished product delivery, trucking underpins modern business operations worldwide.

I. Definition and Classification of Truck Transportation

Truck transportation refers to the movement of goods via motor vehicles (including trucks, tractors, and semi-trailers) across land routes. The industry can be categorized by several criteria:

By Transport Distance:

- Short-haul: Typically under 200 km (124 miles)

- Medium-haul: Between 200-500 km (124-310 miles)

- Long-haul: Exceeding 500 km (310 miles)

By Cargo Type:

- General freight: Everyday goods including consumer products, food, and apparel

- Specialized freight: Hazardous materials, refrigerated goods, oversized loads

By Operational Structure:

- Full truckload (FTL): Shipments occupying an entire trailer

- Less-than-truckload (LTL): Consolidated shipments from multiple shippers

II. Historical Evolution of Trucking

The trucking industry's development parallels automotive technological advancement:

Early Stages (Late 19th-Early 20th Century):

Automotive innovation enabled primitive trucking operations, primarily for urban delivery of coal and construction materials.

Development Phase (1920s-1950s):

Improved vehicle technology expanded payload capacities and range, while highway infrastructure development facilitated regional transport networks.

Maturation Period (1960s-Present):

Containerization revolutionized efficiency, while logistics technology introduced computerized routing and real-time tracking systems.

III. Advantages and Disadvantages

Key Advantages:

- Unmatched flexibility for door-to-door service

- Superior speed for short-medium distance transport

- Adaptability to diverse cargo requirements

- Minimal infrastructure requirements

Notable Disadvantages:

- Higher per-unit costs than rail/water transport

- Limited capacity compared to bulk shipping methods

- Weather vulnerability affecting schedules

- Environmental impact concerns

IV. Economic Impact

Trucking serves critical economic functions:

- Facilitates rapid goods circulation throughout supply chains

- Supports manufacturing through just-in-time component delivery

- Enables cross-border trade movements

- Distributes essential consumer goods

- Generates millions of direct/indirect employment opportunities

V. Market Influencing Factors

Key variables affecting trucking operations include:

- Macroeconomic growth indicators

- Road infrastructure quality

- Fuel price volatility

- Labor market conditions

- Regulatory compliance requirements

- Technological adoption rates

- Geopolitical disruptions

VI. Current Industry Challenges

Critical issues facing the sector:

- Chronic driver shortages across developed markets

- Capacity constraints during peak demand periods

- Rising operational expenses

- Margin compression from competitive pressures

- Emission reduction mandates

- Digital transformation requirements

VII. Strategic Responses

Operational adaptations include:

- Enhanced driver compensation/retention programs

- Route optimization through AI-powered logistics platforms

- Alternative fuel vehicle adoption

- Expanded service offerings (intermodal, warehousing)

- Predictive maintenance systems

VIII. Future Outlook

Emerging industry trends:

- Autonomous driving system integration

- Electrification of medium-duty fleets

- Blockchain-enabled freight tracking

- On-demand digital freight matching

- Customized logistics solutions

IX. Supply Chain Integration

Trucking serves as the connective tissue between:

- Raw material suppliers and production facilities

- Manufacturing plants and distribution centers

- Wholesalers and retail outlets

- E-commerce fulfillment and last-mile delivery

X. Sustainability Considerations

Environmental mitigation strategies:

- Zero-emission vehicle adoption timelines

- Aerodynamic trailer modifications

- Idle reduction technologies

- Driver wellness initiatives

XI. Regulatory Framework

Key governing statutes address:

- Commercial vehicle safety standards

- Hours-of-service compliance

- Hazardous materials handling

- Emissions testing protocols

XII. Forward Projections

The industry anticipates:

- Sustained volume growth matching GDP expansion

- Accelerated technology investment cycles

- Specialized service differentiation

- Consolidation among smaller carriers

- Carbon-neutral operation targets