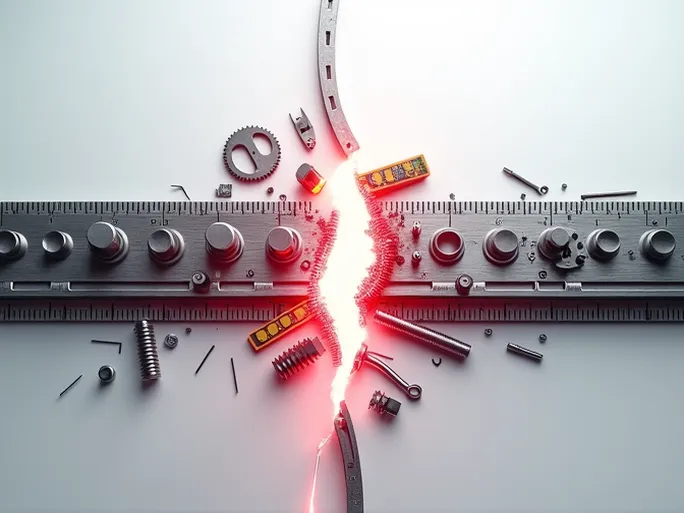

Imagine a manufacturing powerhouse, much like a battlefield general, suddenly crippled by broken supply lines. Oshkosh Corporation, the global leader in specialty vehicles and aerial work platforms, faces precisely this challenge. The company finds itself entangled in the web of global supply chain disruptions that threaten production schedules and test corporate resilience. This analysis examines Oshkosh's supply chain struggles, response strategies, and path forward.

Part I: Oshkosh's Supply Chain Challenges

1.1 Production Delays and Operational Disruptions

CEO John Pfeifer revealed during Q3 earnings calls that extended material transit times from Asia and Europe have pushed delivery schedules back by up to four weeks. These delays translate to frustrated customers, postponed projects, and potential contract penalties. The supply chain crisis has forced multiple unplanned production halts, resulting in idle resources, reduced efficiency, and mounting costs.

1.2 Persistent Uncertainty Through 2021

CFO Michael Pack projected that supply chain challenges would neither improve nor worsen through 2021's remainder. This forecast leaves Oshkosh navigating uncharted territory without clear visibility. The situation proves particularly challenging given the company's heavy reliance on the U.S. market, where surging consumer demand exacerbates existing supply bottlenecks.

1.3 The Ripple Effect: Extended Lead Times and Rising Costs

Material shortages and port congestion have created historic delays in component deliveries. Pfeifer acknowledged underestimating the crisis severity: "While we anticipated some supply chain disruption in the second half, the actual impact proved significantly worse than projected." These miscalculations exposed vulnerabilities in the company's contingency planning.

1.4 Growing Backlog Amid Strong Demand

Oshkosh's order backlog swelled 30% year-over-year, demonstrating robust market demand. However, this success comes with operational headaches as the company struggles to fulfill contracts. Similar challenges plague other manufacturers across industries, from La-Z-Boy's 4-9 month delivery windows to Clorox's ongoing supply-demand imbalance.

1.5 Shipping Crisis Delivers Direct Hit

Shipping disruptions created approximately $100 million in Q3 revenue shortfalls. SEC filings reveal these issues caused "labor inefficiencies and increased expedited freight costs." The compounding effects of workforce productivity losses and premium shipping expenses squeezed profit margins.

1.6 Concentrated Impact on Aerial Equipment

The Access Equipment segment suffered disproportionate damage due to its centralized manufacturing model. Single-point failures can halt entire production lines. Pfeifer cautioned that supply chain headwinds will persist for multiple quarters, with normalization expected only as suppliers adapt to post-pandemic demand surges.

Part II: Root Causes of Supply Chain Disruptions

2.1 Pandemic Shockwaves and Demand Spikes

COVID-19 created unprecedented global economic imbalances. Factory shutdowns collided with stimulus-fueled demand rebounds, creating perfect storm conditions for supply chain chaos.

2.2 Port Gridlock and Transportation Breakdowns

Major global ports face chronic congestion from labor shortages, equipment deficits, and pandemic restrictions. These bottlenecks extend transit times and inflate logistics costs.

2.3 Material Shortages and Inflationary Pressures

Production halts, transportation issues, and geopolitical factors have created critical component shortages. Scarce materials command premium prices, squeezing manufacturer margins.

2.4 Labor Market Dislocations

Workforce shortages plague manufacturing and logistics sectors, exacerbated by skills mismatches. These labor gaps constrain production capacity and operational flexibility.

2.5 Geopolitical Instability

Trade tensions and regional conflicts introduce additional uncertainty, forcing companies to reevaluate supply chain dependencies and risk exposure.

Part III: Oshkosh's Strategic Responses

3.1 Supply Base Diversification

The company can mitigate single-source risks by qualifying alternative suppliers, particularly in nearshore locations. Developing multiple production sites would provide additional redundancy.

3.2 Digital Transformation Initiatives

IoT tracking, AI-driven demand forecasting, and blockchain verification systems could enhance supply chain visibility, efficiency, and security.

3.3 Collaborative Partnerships

Deepening supplier integration through shared planning systems and inventory management could improve coordination. Logistics partnerships may optimize transportation networks.

3.4 Inventory Optimization

Strategic safety stock increases combined with advanced inventory analytics could buffer against delivery delays. Vendor-managed inventory programs might shift some burden to suppliers.

3.5 Pricing and Cost Controls

Selective price adjustments may offset rising input costs. Concurrent operational improvements through lean manufacturing and value engineering could preserve margins.

Part IV: Emerging Opportunities

4.1 Reshoring Potential

Supply chain volatility may justify increased domestic production, reducing international shipping dependencies while shortening lead times.

4.2 Technology Adoption

Crisis conditions could accelerate automation investments and smart logistics implementations that enhance long-term competitiveness.

4.3 Sustainability Integration

Supply chain reevaluation presents opportunities to incorporate eco-friendly materials and energy-efficient processes that align with ESG priorities.

4.4 Customer Communication

Transparent dialogue about delivery challenges can strengthen client relationships during difficult periods.

4.5 Risk Management Enhancements

Developing robust risk assessment frameworks will prove increasingly valuable in an unstable global trade environment.

Part V: The Road Ahead

Oshkosh's supply chain struggles mirror broader manufacturing sector challenges. The company's ability to adapt through diversification, digitization, and collaboration will determine its competitive position. While near-term obstacles remain significant, strategic responses may ultimately strengthen operational resilience. The current crisis underscores that in globalized markets, supply chain management has become a decisive competitive differentiator.