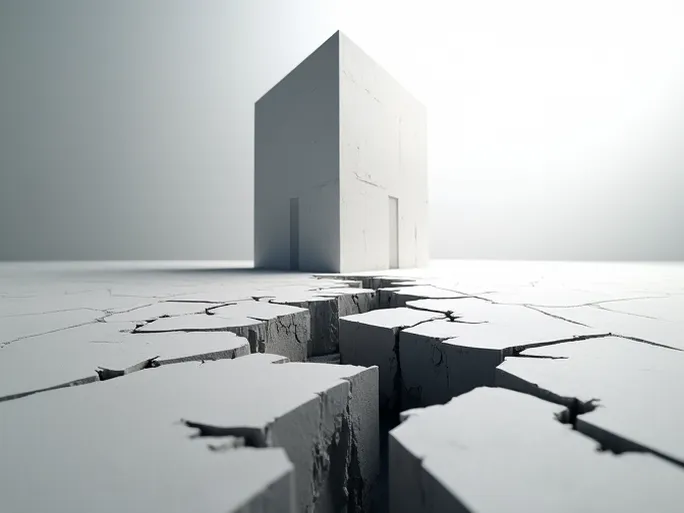

Imagine this scenario: A component supplier that has diligently served an automaker for years finds itself on the brink of bankruptcy due to a contract dispute. The fallout doesn't stop there—it ripples through the entire supply chain and even impacts regional economies. This isn't hypothetical alarmism but a real possibility in today's business landscape. How can companies avoid such pitfalls? This article examines common contract risks for suppliers and offers expert strategies for navigating complex commercial relationships.

I. The Prevalence and Consequences of Contract Risks

In modern commerce, electronic data exchanges between suppliers and manufacturers have streamlined operations but simultaneously increased exposure to contractual vulnerabilities. Ambiguous terms, differing interpretations, or poorly drafted clauses can spark disputes that drain financial resources, consume valuable time, and damage hard-earned reputations.

Contract disputes may fall under various legal frameworks depending on transaction types—including the Uniform Commercial Code (UCC), the United Nations Convention on Contracts for the International Sale of Goods (CISG), or common law principles. Suppliers must thoroughly understand applicable regulations and implement appropriate safeguards.

II. Primary Sources of Contractual Risk

Contract risks often lurk in seemingly innocuous provisions, manifesting in several key forms:

- Ambiguous or poorly defined terms: Vague quality specifications, performance metrics, or delivery requirements invite conflicting interpretations.

- Missing critical provisions: Omissions regarding payment terms, delivery timelines, or liability limitations create enforcement challenges.

- Unbalanced terms: One-sided clauses allowing unilateral modifications or imposing disproportionate penalties may constitute unenforceable provisions.

- EDI system failures: Electronic data interchange errors can lead to version control issues or unacknowledged amendments.

- Unrecorded modifications: Oral agreements or informal changes lacking proper documentation become problematic during disputes.

- Regulatory noncompliance: Contracts violating applicable laws expose parties to unnecessary legal exposure.

III. Case Study: The GM-CCM Contract Dispute

The clash between General Motors and Clark-Cutler-McDermott (CCM) illustrates how even established partnerships can collapse under contractual pressures. As GM's longtime acoustic insulation supplier, CCM saw profit margins evaporate amid relentless price reductions. With losses mounting to $30,000 daily, CCM's bankruptcy filing triggered regional economic consequences extending to raw material providers.

This case underscores critical lessons: Suppliers must negotiate from positions of strength, reject unsustainable terms, and implement robust risk management protocols. Even "partner" relationships require vigilant contract oversight.

IV. Proactive Contract Risk Management Strategies

Sophisticated suppliers employ multilayered defenses against contractual hazards:

- Regular contract audits: Systematically review agreements to ensure compliance with evolving regulations and market conditions.

- Specialized legal review: Engage transactional attorneys to identify problematic clauses and suggest protective language.

- Precision drafting: Replace ambiguous phrases with measurable standards and explicit obligations.

- Change control protocols: Formalize procedures for documenting amendments through written addenda.

- Comprehensive risk frameworks: Develop assessment tools to evaluate contractual exposure across business units.

- Workforce training: Educate procurement teams on contractual pitfalls and negotiation best practices.

- New partner vetting: Conduct thorough due diligence before entering unfamiliar commercial relationships.

V. Navigating Bankruptcy-Related Contract Issues

When counterparties face insolvency, special considerations apply:

- Secure collateral: Obtain liens, guarantees, or other security interests to improve recovery prospects.

- Limit contract duration: Structure agreements with termination options or shorter terms for at-risk partners.

- Monitor financial health: Track warning signs like delayed payments or quality deterioration.

- Assert creditor rights: Promptly file claims and participate in bankruptcy proceedings to maximize recoveries.

VI. Conclusion: Vigilance Ensures Sustainable Growth

Contracts form the foundation of commercial relationships yet represent significant risk vectors. By implementing disciplined review processes, leveraging legal expertise, and maintaining organized documentation, suppliers can transform contracts from potential liabilities into strategic assets. In today's volatile business climate, proactive contract management isn't optional—it's essential for long-term viability.