What began as a promising union between two logistics powerhouses has devolved into a bitter legal battle, with Forward Air and Omni Logistics now locked in a high-stakes dispute over their planned merger. The deal, initially envisioned to create an industry leader, has instead become mired in allegations of breached contracts and bad faith negotiations.

Legal Escalation

Forward Air, the Tennessee-based less-than-truckload (LTL) carrier, has secretly filed a countersuit against Omni Logistics in Delaware's Court of Chancery. This legal maneuver represents Forward Air's attempt to terminate its $3.2 billion merger agreement with the Dallas-based logistics provider, signed on August 10.

The countersuit comes in response to Omni's October 31 lawsuit alleging Forward Air violated merger obligations and seeking to compel completion of the deal. Forward Air maintains it responded to Omni's complaint on November 10 and plans to publicly disclose its legal arguments by November 17.

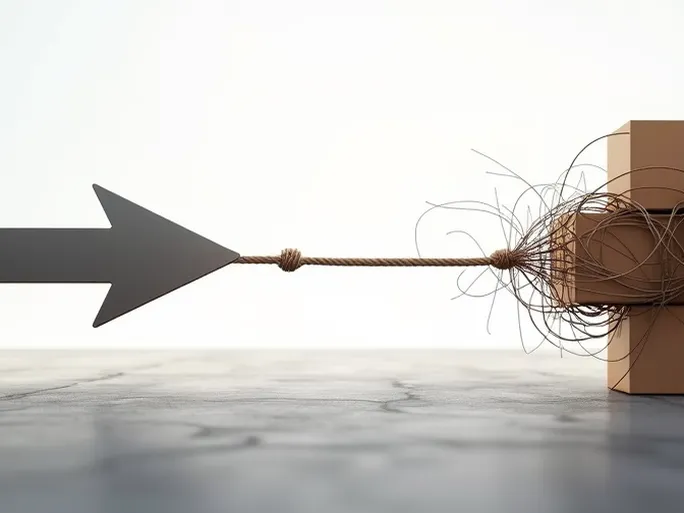

At the heart of the dispute are allegations that Omni Logistics failed to meet obligations under sections 7.03 and 7.14 of the merger agreement. Forward Air claims Omni engaged in "persistent delays and repeated misrepresentations," leading it to conclude that Omni wasn't negotiating in good faith. The Tennessee firm seeks judicial confirmation that it can rightfully terminate the agreement.

From Partnership to Litigation

The unraveling began on October 26 when Forward Air first signaled it might abandon the acquisition. Omni responded five days later with its lawsuit, insisting the merger remains legally binding and beneficial for both companies' stakeholders.

In its court filing, Omni stated it seeks "specific performance to require Forward Air to fulfill its obligation to complete the transaction." The company maintains it has complied with all agreement terms and called Forward Air's allegations "baseless."

Strategic Rationale vs. Financial Reality

The merger initially promised significant synergies, including:

- Creating a scaled LTL leader focused on high-value, time-sensitive freight

- Expanding Forward Air's customer base by 7,000 and enhancing its service portfolio

- Combining Omni's commercial network with Forward's operational precision

Forward Air CEO Tom Schmitt had enthusiastically described the strategic fit during August interviews, praising Omni as "the best commercial machine at selling high-value freight" to complement Forward's operational strengths. He highlighted benefits for high-value shipments like medical equipment and touring concert gear where on-time, damage-free delivery is critical.

However, Forward's third-quarter results revealed deteriorating financials, with net income plunging 82.2% year-over-year to $9.29 million. During the October 31 earnings call, Schmitt signaled a strategic retreat, stating Forward "strongly believes it has no obligation to complete the transaction."

Analysts have viewed abandoning the deal as potentially positive for Forward Air. Robert W. Baird's Garrett Holland noted refocusing on core LTL operations could improve profitability, though uncertainty persists until the legal dispute resolves.

As both companies prepare for protracted litigation, the logistics industry watches closely—not just for the outcome of this particular merger, but for what it might signal about consolidation trends in the fragmented transportation sector.