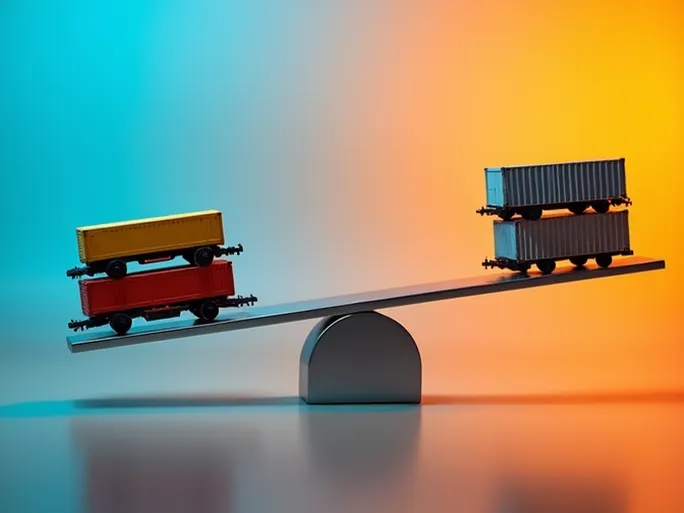

Imagine you're a logistics manager staring anxiously at your computer screen, trying to decide between rail or road transport for your cargo. The latest rail freight data from the Association of American Railroads (AAR) might make your decision even harder. The report reveals a tale of two markets: traditional carload traffic shows modest growth while intermodal transportation - the rising star of recent years - has taken a downturn. What does this divergence mean, and how might it reshape future logistics strategies?

Carload Traffic: A Glimmer of Hope in Economic Winter

The data shows U.S. rail carloads reached 230,545 units for the week ending January 21, marking a 3.3% year-over-year increase. While not spectacular, this growth provides welcome relief amid growing economic pressures. Compared to previous weeks, the numbers show a fluctuating upward trend - slightly below the 244,171 carloads recorded on January 14 but significantly higher than the 212,962 units from January 7.

Digging deeper reveals a mixed performance across commodity categories. Of the ten major categories tracked by AAR, five showed growth while five declined. Non-metallic minerals led the gains, adding 5,895 carloads to reach 31,264 units. Coal transportation also performed well, increasing by 2,454 carloads to 68,675 units. The automotive sector saw growth too, with 2,321 additional carloads bringing the total to 13,166 units.

However, not all sectors shared this positive momentum. Chemical shipments declined by 2,891 carloads to 31,038 units, grain transport fell by 1,262 carloads to 22,015 units, and forest products decreased by 799 carloads to 9,065 units. These variations reflect the distinct challenges and opportunities facing different industries.

Intermodal: The Former Star Loses Its Shine

In stark contrast to carload traffic's modest gains, intermodal transportation suffered a significant setback. U.S. railroads moved 236,940 containers and trailers during the week, representing a 6.7% year-over-year decline. While this figure exceeds the 203,257 units from January 7, it falls well short of the 241,829 units recorded on January 14, showing a clear downward trajectory.

Intermodal transportation, which combines rail, road, and sometimes maritime transport, has gained prominence in recent years for its cost efficiency, environmental benefits, and operational flexibility - qualities that positioned it as the future of logistics. The latest data suggests this promising sector now faces unexpected challenges.

Cumulative Data: Revealing Clearer Trends

Examining cumulative data from the first three weeks of the year paints a clearer picture. U.S. railroads moved 687,678 carloads during this period, up 3% from last year. Meanwhile, intermodal volume totaled 682,296 units, representing a substantial 8.4% decline. This establishes a clear pattern of "strong carloads, weak intermodal" performance in the early 2023 rail freight market.

North American Railroads: A Mixed Performance

Expanding the view to include Canada and Mexico reveals similar trends across North America. The 12 major railroads in these countries moved 336,113 carloads during the week ending January 21 - a 6.8% year-over-year increase. Intermodal volume reached 309,502 units, down 6.7% from last year. Combined North American rail freight totaled 645,615 units (carloads plus intermodal), showing a slight 0.1% decline.

For the first three weeks of 2023, North American railroads moved 1,893,180 combined units, representing a 0.5% decrease from 2022. These numbers suggest that while carload growth partially offsets intermodal declines, the overall rail freight market shows signs of contraction.

Behind the Numbers: Multiple Contributing Factors

Several interconnected factors likely explain these divergent trends:

Economic Conditions: Growing global economic pressures have reduced overall freight demand, particularly affecting intermodal transportation which typically serves longer hauls more sensitive to economic fluctuations.

Supply Chain Challenges: While supply chain bottlenecks have eased somewhat, issues like port congestion and truck driver shortages continue impacting intermodal efficiency and reliability.

Energy Prices: Fluctuating fuel costs affect transportation economics. Rising diesel prices, for instance, could make rail more competitive against trucking.

Policy Environment: Government infrastructure investments and regulatory changes could influence rail's competitive position.

Seasonal Patterns: Certain commodities like agricultural products follow seasonal demand cycles that affect carload volumes.

Competitive Dynamics: Pricing strategies among railroads and between transport modes create shifting market shares.

Technological Innovation: Rail automation and digitalization could improve efficiency and service quality.

Looking Ahead: Navigating Challenges and Opportunities

The U.S. rail freight market faces both headwinds and opportunities moving forward. Persistent economic uncertainty and supply chain vulnerabilities may continue pressuring the sector. However, infrastructure modernization, technological advancement, and potential modal shifts could create new growth avenues.

For logistics professionals, this environment demands careful monitoring and flexible strategies that leverage rail's strengths while remaining adaptable to intermodal's evolving role. Success will require balancing cost efficiency with service reliability in an increasingly complex transportation landscape.

The contrasting performance between carload and intermodal rail traffic reflects broader economic complexities. How this divergence develops could signal important changes in transportation patterns and supply chain strategies in the months ahead.