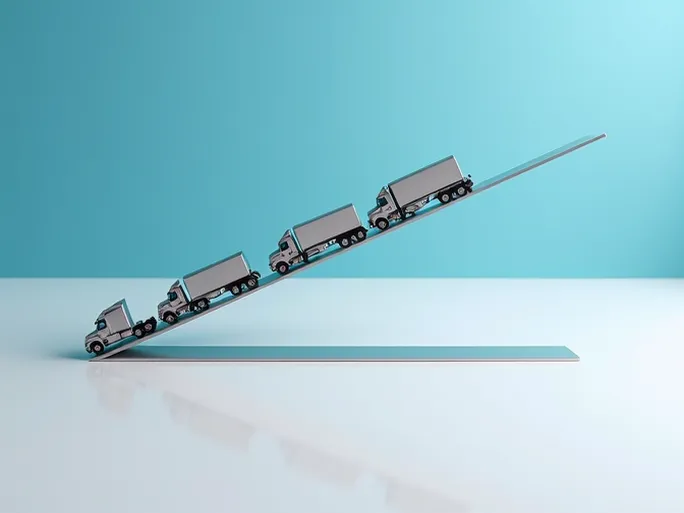

I magine this: bustling logistics hubs suddenly growing quieter, fewer trucks barreling down highways... These subtle changes may signal shifting economic winds. According to the latest report from the American Trucking Associations (ATA), the seasonally unadjusted truck tonnage index fell to 125.5 in February, marking a 4.6% decline from January's 131.7 reading.

What does this mean? In simple terms, trucks are moving fewer goods. The unadjusted data directly reflects actual monthly changes in freight volumes transported by truck. Declining shipment volumes may indicate slowing business production activity and weakening consumer demand—factors that ultimately impact the broader economy.

While a single month's fluctuation doesn't necessarily establish a trend, economists suggest close monitoring of subsequent developments. The trucking industry serves as a critical component of economic infrastructure, with freight volume changes frequently regarded as a reliable barometer of overall economic activity.

Historically, truck tonnage trends have correlated closely with GDP growth patterns. The current dip follows several months of relatively stable readings, raising questions about whether this represents temporary volatility or the beginning of a more sustained slowdown. Industry analysts note that fuel prices, inventory levels, and retail sales patterns all contribute to freight demand fluctuations.

The transportation sector's performance often precedes broader economic trends by weeks or months, making it a valuable early indicator. As businesses adjust orders based on anticipated demand and consumers modify spending habits in response to economic conditions, these decisions manifest quickly in freight volumes before appearing in traditional economic metrics.