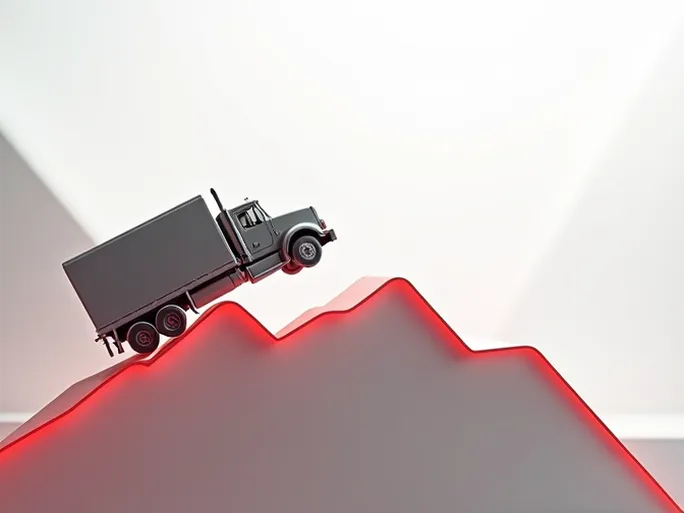

Trucks, often described as the arteries of the U.S. economy, carry freight that serves as a barometer of economic health. Recent data from the American trucking industry, however, has sounded alarm bells about potential economic headwinds.

Key Metrics Show Concerning Decline

The American Trucking Associations (ATA) reported its seasonally adjusted For-Hire Truck Tonnage Index fell to 109.8 (2015=100) in July, marking a 1.2% decrease from June. This follows a revised 2% decline in June (initial estimate was -1.5%, with final June reading at 111.1). More troubling, July's index showed a 2.9% year-over-year decrease—the first annual decline since March—while June's figures remained flat year-over-year. Year-to-date figures show a 0.2% cumulative decrease.

The unadjusted index stood at 111.9 in July, down 3.2% from June's 115.6. The ATA emphasized that its index primarily measures contract freight rather than spot market shipments.

Supply Constraints Outweigh Demand Factors

ATA Chief Economist Bob Costello suggested the recent weakness in freight volumes stems more from supply limitations than weakening demand. "Beyond broader supply chain issues like semiconductor shortages, the trucking sector faces specific challenges including driver shortages and equipment constraints," Costello noted.

"With fleets operating fewer trucks than last year, it becomes difficult to move more freight when you have fewer trucks and drivers available," Costello explained.

The economist pointed to softening in two key truck freight indicators—retail sales and housing starts—which both declined monthly in July though maintaining year-over-year growth.

Capacity Crisis Reaches Historic Levels

Jeff Tucker, president of New Jersey-based Tucker Worldwide, echoed these concerns, citing Morgan Stanley research indicating the 2021 capacity crunch may have surpassed even 2018's record tightness. "We've been operating at historically constrained capacity levels for several months now," Tucker observed.

This perspective reinforces the significance of supply-side limitations in understanding the freight volume declines. The current capacity crisis appears more severe than previous cycles, creating unprecedented challenges that affect both shipment volumes and transportation costs throughout supply chains.

Multifaceted Causes Behind the Decline

Analysis of industry data and expert commentary reveals July's freight contraction resulted from intersecting demand and supply factors:

Demand-side pressures: Declining retail sales and housing starts—both major drivers of truck freight—suggest cooling consumer demand and construction activity.

Supply-side constraints: Chronic driver shortages have intensified due to pandemic-related retirements and recruitment challenges. Equipment availability remains constrained by semiconductor shortages affecting truck production. Broader supply chain disruptions—including port congestion and container imbalances—further reduce transportation efficiency.

Industry Outlook: Navigating Challenges

The trucking sector faces continued headwinds from persistent driver shortages, equipment limitations, and supply chain volatility. Demand uncertainty adds complexity, with inflation, rising interest rates, and geopolitical tensions potentially affecting consumption patterns and economic growth.

Yet opportunities emerge alongside challenges. E-commerce expansion continues driving freight demand, while autonomous vehicle technology may eventually alleviate driver shortages. Infrastructure investments could enhance roadway efficiency, and operational innovations may improve fleet productivity.

Industry leaders emphasize strategic responses: enhancing driver recruitment and retention programs, modernizing fleets despite equipment shortages, strengthening supply chain collaboration, and maintaining operational flexibility to adapt to market shifts.