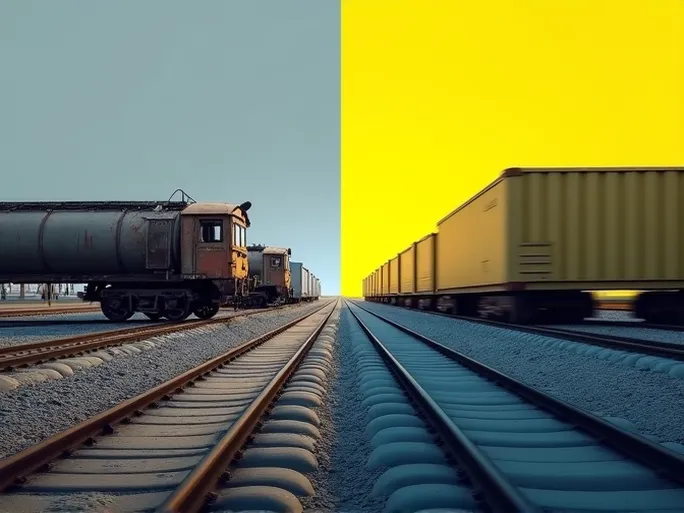

The U.S. rail freight market is exhibiting a fascinating divergence, with traditional carload traffic showing signs of weakness while intermodal transportation demonstrates robust growth. This development signals potential shifts in the nation's logistics landscape and broader economic trends.

Key Data Highlights: Mixed Performance in Rail Volumes

According to the latest data from the Association of American Railroads (AAR) for the week ending March 16 (reported March 23), several key trends emerge:

- Carload traffic dipped slightly: Total carloads reached 219,586, representing a 0.6% year-over-year decline. While marginally lower than previous weeks, volumes remain relatively stable.

- Intermodal shines: Containers and trailers totaled 255,010 units, surging 13.8% compared to the same period last year. This strong performance underscores intermodal's growing role in meeting logistics demands.

- Overall growth maintained: Combined rail traffic reached 474,596 units, up 6.7% year-over-year, with intermodal's strength offsetting carload weakness.

Sector Analysis: Winners and Losers in Commodity Shipping

The carload segment reveals significant variations across commodity categories:

Growing categories:

- Grain: Increased by 3,638 carloads to 21,108, likely reflecting strong global demand and the U.S.'s position as a major grain exporter.

- Chemicals: Rose by 2,186 carloads to 33,134, indicating expansion in manufacturing and industrial production.

- Petroleum products: Grew by 1,836 carloads to 9,954, potentially driven by increased energy demand and domestic oil production.

Declining categories:

- Coal: Fell sharply by 12,033 carloads to 55,990, continuing its long-term decline amid energy transition trends.

- Metals and ores: Decreased by 903 carloads to 18,683, possibly reflecting global economic softness.

- Forest products: Slipped by 92 carloads to 8,431, potentially due to construction sector volatility.

Year-to-Date Trends: Intermodal Gains Momentum

The broader 2024 picture reinforces these patterns:

- Carload traffic totals 2,344,887 units, down 4.1% year-over-year.

- Intermodal volumes reach 2,759,413 units, up 9.0% compared to 2023.

Market Dynamics: Why Intermodal Thrives

Several factors drive intermodal's outperformance:

- Operational flexibility: Seamless integration between rail, truck, and maritime transport.

- Efficiency gains: Optimized intermodal connections reduce transit times.

- Cost advantages: Rail's economic benefits for long-haul shipments.

- Sustainability: Lower emissions compared to all-truck alternatives.

Industry Challenges: Baltimore Bridge Collapse Impact

Dr. Rand Ghayad, AAR Senior Vice President of Policy and Economics, noted the Francis Scott Key Bridge collapse presents logistical challenges. While long-term effects remain uncertain, railroads demonstrate adaptability in rerouting traffic and minimizing disruptions.

Future Outlook: Navigating a Transforming Market

The rail freight sector faces both opportunities and challenges:

Growth drivers:

- Potential economic expansion

- Infrastructure investment

- Technological innovation in automation and digitization

Potential headwinds:

- Competition from trucking and other modes

- Regulatory constraints

- Labor relations considerations

The U.S. rail freight market continues evolving, with intermodal growth counterbalancing traditional carload declines. Industry adaptability will prove crucial in maintaining competitiveness amid infrastructure challenges and shifting logistics demands.