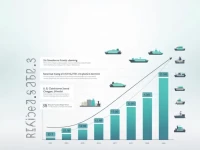

US Container Imports Slow in August Amid Demand Concerns

S&P Global data indicates that U.S. container imports grew by 10.8% year-over-year in August, but the growth rate slowed, decreasing by 2.6% compared to July. Imports of consumer goods and capital goods showed divergent trends. Experts believe that demand persists, but growth momentum is weakening. Businesses should closely monitor market dynamics, flexibly adjust inventory, diversify supply chains, strengthen risk management, and improve operational efficiency.