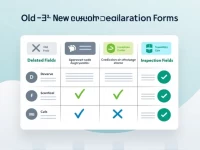

Understanding Recent Changes in Import and Export Customs Declaration Forms

This article provides a detailed comparison of the main changes between the old and new customs declarations, including the deletion, addition, and modification of fields. Many irrelevant pieces of information have been removed, while new fields have been added to ensure tax collection and prevent infringement. Several field names have been adjusted for clarity, and the number of product items has increased to facilitate trade. Overall, these adjustments aim to enhance customs regulatory capabilities and improve trade efficiency.