Import Display Screen Customs Clearance Strategies and 3C Certification Solutions Analysis

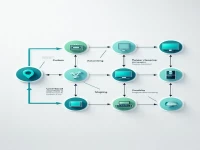

This article analyzes the import clearance process and strategies for display screens, with a focus on solutions for mandatory 3C certification. It summarizes various response strategies and provides practical advice for addressing import clearance issues, including applying for 3C certification, conducting non-catalog assessments, and seeking exemptions based on intended use.