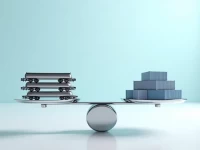

US Rail Freight Volumes Drop Amid Economic Slowdown

Data from the Association of American Railroads shows that U.S. rail freight and intermodal traffic both declined year-over-year for the week ending April 23rd. This decrease is attributed to factors including slowing economic growth, supply chain bottlenecks, energy transition, and increased competition. To address these challenges and achieve sustainable development, the rail industry needs to improve operational efficiency, expand diversified business lines, strengthen infrastructure construction, and embrace digital transformation.