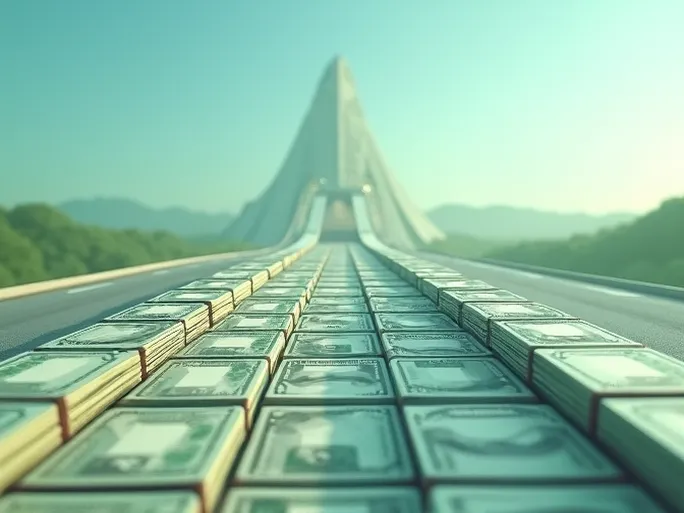

As the holiday season winds down and a new year begins, one industry remains the backbone of America's efficient logistics system - trucking. Despite fluctuations in various transportation sectors, trucking continues to dominate freight movement in both tonnage and revenue. The American Trucking Associations' (ATA) latest annual forecast report, "ATA Freight Transportation Forecast 2024-2035," confirms this dominance and paints an optimistic picture for the industry's future growth.

ATA Forecast: Truck Tonnage Set to Rise

The report projects U.S. truck tonnage will grow by 1.6% in 2025, reaching nearly 1.4 billion tons by 2035. With trucking consistently handling over 70% of U.S. freight, these projections reflect careful analysis of long-term industry trends. Key findings include:

- Tonnage Growth: Total truck tonnage is expected to increase from 11.27 billion tons in 2024 to 13.99 billion tons by 2034, capturing 76.8% of the freight market by 2035.

- Revenue Growth: Industry revenues are forecast to surge from $906 billion in 2024 to $1.46 trillion by the end of the projection period.

- Other Modes: Rail's share is expected to decline from 10.6% in 2024 to 9.9% by 2035, while intermodal rail is projected to grow 2.9% through 2030. Air cargo, domestic waterborne, and pipeline transportation are all anticipated to see tonnage gains.

Industry Perspective: Trucking as Supply Chain Cornerstone

"Trucking continues to dominate the freight transportation industry in both tonnage and revenue, accounting for 72.7% of tonnage and 76.9% of revenue in 2024," said ATA Chief Economist Bob Costello. "We expect this market share to remain stable as America continues relying on trucks to move the vast majority of goods."

ATA President and CEO Chris Spear emphasized the report's value for industry leaders shaping trucking's future, stating "knowledge is power." He added, "Understanding our supply chain trends is critical for decision-makers in Washington, state capitals, and anywhere trucking and our economy are impacted."

Supply Chain Fundamentals: Trucking's Essential Role

While supply chains may appear fragmented with multiple modes, regulations, and emerging technologies like digital brokerage, last-mile delivery, and artificial intelligence, most shipments begin and end with trucks. The data clearly shows trucking remains indispensable to the nation's supply chain regardless of economic conditions.

Deep Dive: Factors Shaping Trucking's Future

The report provides comprehensive analysis of key influences on the industry:

Macroeconomic Conditions

Economic growth drives freight demand, with moderate expansion expected through 2035. However, inflation, interest rates, and geopolitical risks present potential challenges.

Demographic Shifts

An aging population and urbanization may exacerbate driver shortages and traffic congestion, requiring operational adjustments.

Technological Innovation

Advancements in autonomous vehicles, electric trucks, and digital transformation promise efficiency gains but require significant investment.

Regulatory Environment

Increasing safety, environmental, and labor regulations will shape operational practices and costs.

Consumer Behavior

E-commerce growth and demand for customized services continue reshaping freight patterns and service expectations.

Challenges and Opportunities

The industry faces several hurdles including driver shortages, fuel costs, congestion, and regulatory pressures. However, economic expansion, e-commerce growth, technological improvements, and infrastructure investments present significant opportunities.

To remain competitive, carriers must address workforce challenges through better compensation and working conditions, optimize operations through technology, and adapt to evolving customer needs with flexible service models.

Conclusion

The ATA's forecast underscores trucking's vital role in the U.S. economy and its potential for sustained growth. While challenges exist, the industry's ability to adapt to technological, regulatory, and market changes positions it for continued success in moving America's freight.